Understanding Industrial Property: A Comprehensive Guide for Investors

16th September 2024

In the world of commercial real estate, industrial property stands out as a vital segment that drives the economy through production, logistics, and distribution. While residential and office real estate often receive more attention, the demand for industrial real estate has surged in recent years, especially with the boom of e-commerce and global supply chain advancements.

As more businesses require larger spaces for manufacturing, storage, and the distribution of goods, investing in industrial property has become an attractive proposition for real estate investors. In this blog, we will delve deeper into the world of industrial properties, explore their different types, highlight the benefits of investing in them, and offer tips for potential investors.

What is Industrial Property?

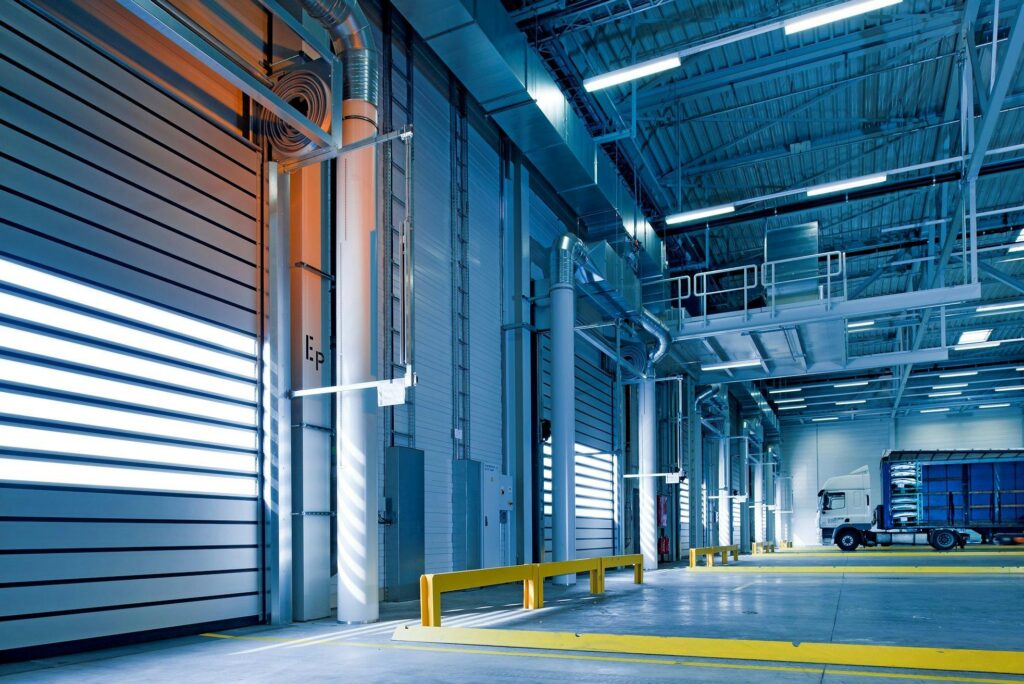

At its core, industrial property refers to real estate that is used for manufacturing, production, storage, and distribution of goods. These properties are designed specifically for business operations that involve large-scale industrial activities. Unlike other forms of commercial real estate, industrial properties are generally more functional, focusing on space efficiency and logistical needs.

Examples of industrial properties include large warehouses for rent, manufacturing buildings, distribution centers, and flex space that can accommodate a variety of business functions. These buildings are often located near key transportation networks such as highways, railroads, and ports, making it easier to move goods quickly.

Types of Industrial Properties

There are several types of industrial properties, each serving different business needs. Understanding the differences can help you decide which type of property to invest in:

- Manufacturing Buildings

Manufacturing buildings are designed for companies involved in the production and assembly of goods. These facilities house large machinery, equipment, and production lines. There are two categories of manufacturing buildings:- Heavy Manufacturing: These facilities accommodate large-scale industrial operations, such as automotive assembly plants or steel production facilities. They often require special infrastructure, such as reinforced floors and advanced power supplies.

- Light Manufacturing: These are smaller in scale and usually involve assembling products or producing goods on a less intensive level. Examples include electronics or small appliance manufacturing.

- Warehouses

Warehouses are large spaces used primarily for storing goods before they are distributed to retailers or consumers. With the rise of online shopping, the demand for warehouse spaces has skyrocketed, particularly in cities where businesses need space for inventory.- General Warehouses: Used for storing goods in bulk, these facilities often include loading docks for trucks and forklifts.

- Cold Storage Warehouses: These are specialized warehouses equipped with refrigeration for storing perishable goods like food or pharmaceuticals.

- Fulfillment Centers: With the rise of e-commerce, fulfillment centers have become critical. These distribution centers focus on storing and shipping online orders as quickly as possible.

- Flex Space

Flex spaces combine industrial and office functionalities into a single property. These spaces can be used for a variety of activities, including light manufacturing, product development, office work, or even showrooms. Flex spaces provide versatility for businesses that need a multifunctional environment, making them highly desirable. - Distribution Centers

Distribution centers are designed to facilitate the quick movement of goods. These properties are usually large and located near transport hubs such as highways or airports. Distribution centers are often equipped with automated systems that help companies move products efficiently. The demand for logistics property investment is increasing as companies aim to streamline their supply chain processes.

Benefits of Investing in Industrial Property

Investing in industrial real estate offers several advantages, especially in the current global economic climate. Here are some key benefits:

- High Demand Due to E-commerce Growth

The rapid growth of e-commerce has created a huge demand for warehouses and distribution centers. Online retailers need large amounts of storage space for their products and require strategically located properties to ensure fast shipping. As businesses look to optimize delivery times, the value of industrial property near transport hubs has skyrocketed.

In fact, the need for warehouse spaces is so high that vacancy rates for industrial real estate are often much lower than other commercial sectors like retail or office spaces. This makes industrial properties a solid investment with a stable income stream. - Long-Term Tenants

One of the key advantages of industrial property investment is the likelihood of securing long-term tenants. Companies involved in manufacturing, warehousing, and logistics often make significant capital investments in customizing the property to meet their operational needs. As a result, they are more inclined to sign long-term leases, ensuring stable rental income for the property owner. - Lower Vacancy Rates

Industrial real estate tends to have lower vacancy rates compared to other types of commercial properties. This is especially true for warehouse spaces and distribution centers located near major cities or transportation hubs. Businesses often compete for well-located industrial properties, ensuring that landlords enjoy high occupancy levels and consistent rental income. - Higher ROI

The ROI (Return on Investment) for industrial properties is often higher than other types of commercial real estate. This is due to the relatively lower upfront cost of industrial buildings compared to office spaces or retail properties, coupled with strong demand from tenants who need reliable, long-term leases. This makes industrial properties an attractive investment option for those looking to diversify their portfolios. - Inflation Hedge

Industrial leases often include provisions for rental increases tied to inflation or market changes. As a result, industrial properties can serve as a hedge against inflation, providing owners with the ability to increase rents over time and maintain strong cash flow even in fluctuating economic conditions.

Key Considerations for Industrial Property Investors

While industrial property investment offers lucrative opportunities, there are several factors that investors need to carefully consider:

- Location is Critical

Location is perhaps the most important factor when investing in industrial properties. Ideally, industrial real estate should be located near major transportation routes, ports, or airports. This helps businesses reduce shipping times and transportation costs, making the property more attractive to potential tenants. - Building Specifications

Not all industrial buildings are created equal. Some businesses require high ceilings, reinforced flooring, loading docks, or specific power capabilities. Investors need to ensure the property meets the operational requirements of potential tenants. Customizing or retrofitting the building for a specific business can significantly increase its value. - Zoning and Regulatory Compliance

Zoning laws are critical when investing in industrial real estate. Different regions have specific regulations for industrial property usage, such as noise restrictions, waste disposal, or environmental impact standards. It’s essential to ensure that the property complies with local zoning laws and other regulations to avoid potential fines or legal issues. - Market Trends

Staying informed about market trends is key to making informed investment decisions. For example, with the shift towards automation in logistics and manufacturing, demand for smart warehouses and automated distribution centers is on the rise. Similarly, the increasing reliance on just-in-time delivery models means that industrial properties near urban areas may see higher demand. - Tenant Mix

Consider the types of businesses that may rent your property. For example, logistics companies, manufacturers, and e-commerce retailers often have different needs. Understanding your target tenant can help you design or select an industrial property that meets their specific requirements.

Conclusion

In an ever-evolving economic landscape, industrial real estate investment continues to be a promising opportunity for those looking to diversify their portfolios. Whether it’s manufacturing buildings, warehouse spaces, or distribution centers, the demand for well-located and functional industrial properties is on the rise.

The key to successful industrial property investment lies in understanding the market, staying ahead of trends, and selecting properties that cater to long-term tenant needs. With the global growth of e-commerce and logistics, investors who take advantage of these opportunities today are likely to see strong returns in the future.

Investing in industrial property may just be the smart move you need to build a secure and prosperous future.

Register Your Interest

Recent posts

Understanding Leasehold Properties: What You Need to Know

An Ultimate Guide to Fractional Ownership Real Estate in India.

What is Khasra Number? A Complete Guide

Effective tax planning strategies for buying property in India